Banking in the Age of Artificial Intelligence: Digitalization, Risk Perception, and Ethical Transformation

Chapter from the book:

İnci,

Ü.

H.

(ed.)

2025.

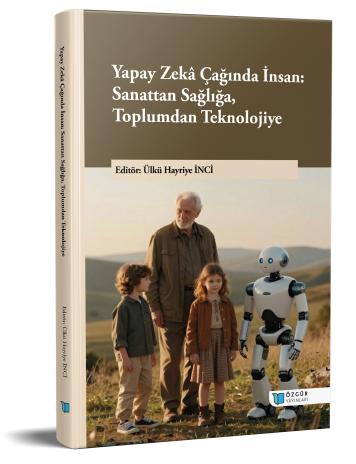

Humans in the Age of Artificial Intelligence: From Art to Health, Society to Technology.

Synopsis

The banking sector has undergone a rapid digital transformation in recent years, driven by technological advancements. The widespread adoption of artificial intelligence, big data, blockchain, and financial technologies has led to a shift from traditional banking models to digital and branchless banking applications. While this transformation provides advantages in speed, cost, and accessibility in banking services, it has also brought about significant changes in risk perception, trust mechanisms, and decision-making processes. This study first examines the digital transformation process in the banking sector and the fundamental characteristics of digital banking. Secondly, it investigates the impact of AI and data analytics-based applications on credit rating, risk management, and operational processes. Thirdly, it evaluates the financial inclusion and ethical dimensions of trust, user behavior, and algorithmic decision-making processes in digital banking. Furthermore, it examines the potential impacts of increasing cyber risks, explainability issues, and compliance costs on banks and customers during the digitalization process. The study is expected to contribute to the understanding of digital banking not merely as a technological transformation, but as a multi-dimensional process encompassing risk, trust, and human factors, and to offer a holistic perspective to the literature.